Found in 1 comment on Hacker News

dzink · 2013-11-10

· Original

thread

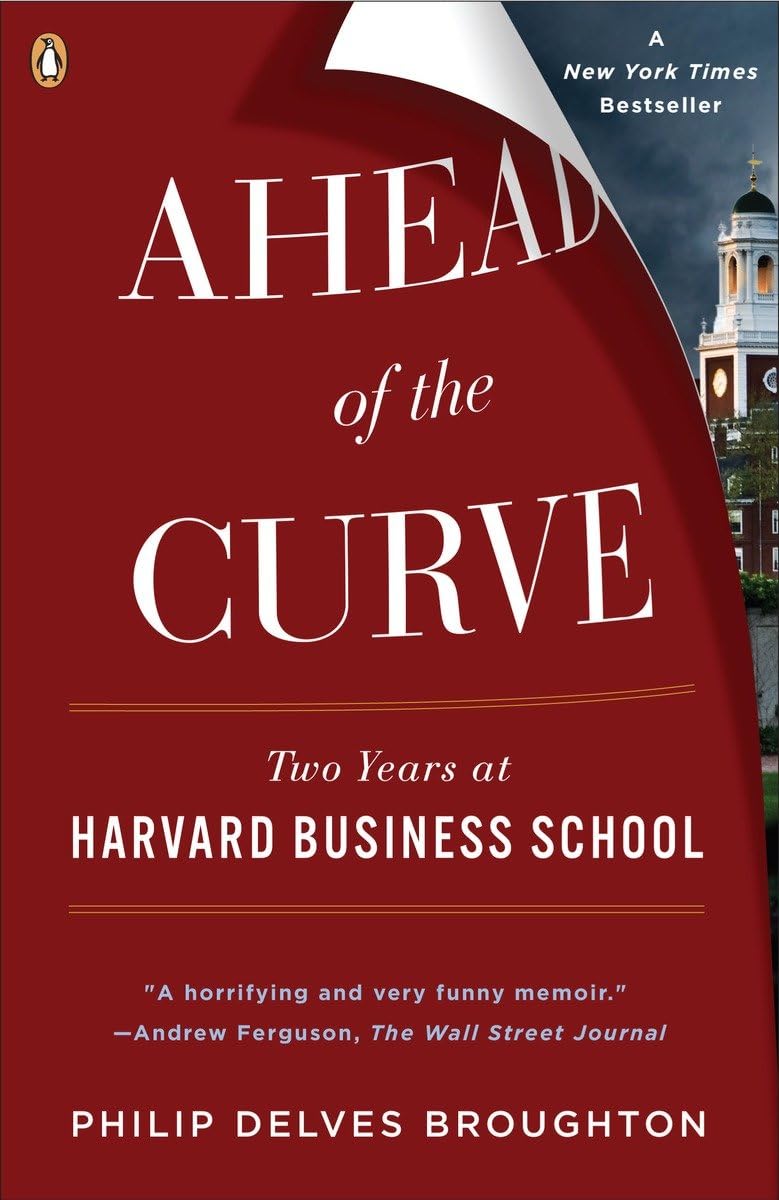

Yes, I think I red it in "Ahead of the Curve" ( http://www.amazon.com/Ahead-Curve-Harvard-Business-School/dp... ) and the author backed it up with data from the most recent tech and financial bubbles. The exact quote escapes me.